REGISTER A TRUST

Keynotes on 20,000/- Trust Registration

- t takes 10 to 15 days for Trust Registration

- Completely online service – No physical presence required

- No minimum capital requirement

Registering a trust requires essential documents such as a trust deed and a rental agreement. At NYAY SARTHI INDIA FILINGS, our team of experienced professionals is well-versed in the online trust registration process, ensuring a smooth and efficient experience.

We provide expert assistance throughout the entire trust formation process, addressing any legal challenges along the way. You can count on us for cost-effective trust registration services, tailored to meet the needs of your start-up.

Online Trust Registration Procedure at Affordable Fees

- To register a trust, you’ll need essential documents such as the trust deed and rental agreement. At NYAY SARTHI INDIA FILINGS, our experienced professionals are well-versed in the online trust registration process, ensuring a smooth and efficient registration experience.

Our experts provide comprehensive assistance throughout the trust formation process, helping you navigate any legal challenges. Feel free to reach out to us for information about our affordable trust registration fees as you set up your startup.

Public trusts are a straightforward way to establish a non-governmental organization (NGO) with a social objective, such as alleviating poverty. If you wish to register your trust online without facing legal complications, contact us as soon as possible. We will ensure your trust registration documents are processed correctly and guide you in establishing your startup.

Get in touch with us to learn about the ideal procedure for trust registration services. At NYAY SARTHI INDIA FILINGS, we are dedicated to delivering business services with a quick turnaround time. We collaborate exclusively with qualified and experienced professionals to guarantee top-quality service at competitive prices.

So, what are you waiting for? It’s time to launch your startup!

What is a Trust?

Understanding Trusts Under the Indian Trust Act

According to the Indian Trust Act, a trust is created when the author demonstrates a clear intention to:

Establish a trust as per their will

Define the trust’s objectives

Specify the beneficiaries

Identify the trust property and arrange its transfer to the trustee (unless created via will or if the author acts as trustee)

Types of Trusts in India

Trusts are broadly classified into two categories:

1. Public Trust

Beneficiaries: General public (wholly or partially)

Sub-types:

Public Charitable Trust

Public Religious Trust

Considered non-profit NGOs

2. Private Trust

Beneficiaries: Specific individuals or families

Sub-types:

Private Specific/Discretionary Trust (clearly defined beneficiaries & shares)

Indeterminate Trust (beneficiaries/shares undefined)

Hybrid Trusts (Public-cum-Private)

Partial income for public welfare, partial for private individuals

Tax Exemption (Section 11): Only if created before April 1, 1962

Key Trust-Related Terms

Trustee

The person who accepts responsibility from the settlor.

Eligibility: Any individual capable of holding property.

Acceptance: Must be explicit (verbal/written).

Disclaimer: A trustee may refuse within a reasonable period.

Duties: Must act in the trust’s best interest, avoid personal gain, and follow settlor’s guidelines.

Author/Settlor

The creator of the trust.

Eligibility: Any legally competent person (minors require court approval).

Beneficiaries

Individuals entitled to trust benefits.

Rights: Can claim profits, request trust documents, and renounce benefits.

Trust Property

The assets/money designated for the trust.

Trust Deed

A legally binding document outlining:

Trust’s purpose

Settlor’s intent

Property details

Beneficiaries & trustee responsibilities

Mandatory for registration, especially if involving immovable property.

Trust Registration Process

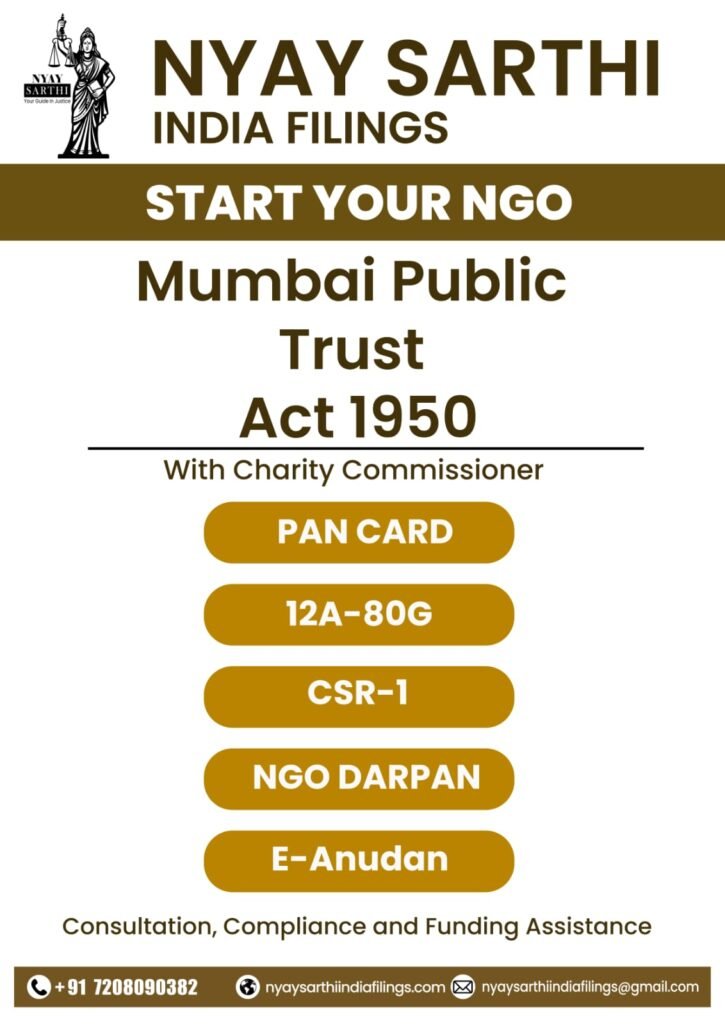

Public charitable trusts must register with the Charity Commissioner’s office in their operational jurisdiction.

Proper documentation (trust deed, rental agreement, etc.) is essential.

Why Choose NYAY SARTHI INDIA FILINGS?

At NYAY SARTHI INDIA FILINGS, our experts simplify trust registration with:

✔ End-to-end legal assistance

✔ Affordable & transparent fee structure

✔ Quick processing & compliance guidance

Launch your trust with confidence! Contact us today for seamless registration. 🚀

Trust Registration Procedure

Complete Guide to Trust Registration with NYAY SARTHI INDIA FILINGS

Registering a trust involves a systematic process. Here’s a step-by-step breakdown of how NYAY SARTHI INDIA FILINGS can assist you:

Step 1: Choose a Trust Name

Select a unique name that complies with the Emblems and Names Act, 1950.

Avoid names implying government affiliation or those on the restricted list.

If a name is rejected, we help file an appeal with higher authorities.

Step 2: Identify the Author/Settlor & Trustees

Settlor: Typically one, but multiple are allowed.

Trustees: Minimum two (no upper limit).

Eligibility:

Indian residents only (NRIs/foreigners ineligible).

Minimum age: 18 for females, 19 for males.

Settlors usually don’t act as trustees unless specified.

Step 3: Draft the Trust Deed (MOA & Rules)

The trust deed must include:

Memorandum of Association (MOA) Clauses

✔ Settlor & Trustee Details

✔ Name & Registered Office Address

✔ Objectives & Beneficiaries

✔ General Body Member List (names, addresses, signatures)

Rules & Regulations

✔ Subscription & Membership Terms

✔ Trustee Appointment/Removal Process

✔ Meeting & Audit Procedures

✔ Bank Account Operations

✔ Compliance with Indian Trust Act, Income Tax Act, etc.

Key Considerations

Immovable property must be registered per Section 21, Indian Registration Act, 1908.

Stamp duty varies by state (we guide you on the correct valuation).

Our experts ensure a legally sound deed to avoid future disputes.

Step 4: Submit Required Documents

Essential Documents

✅ Original Trust Deed (on stamp paper)

✅ Settlor & Trustee ID Proofs (Aadhaar, PAN, Passport)

✅ Address Proof of Registered Office

✅ Witness Details (2 witnesses with IDs)

Important Notes

Settlor must sign every page of the deed copy.

Some states require trustees’ physical presence; others accept notarized consent.

Step 5: Submit the Trust Deed to Registrar

Our team assists in:

✔ Preparing attested copies

✔ Scheduling registrar appointments

✔ Ensuring settlor & witnesses are present (with original IDs)

Step 6: Registration Confirmation

The registrar retains a copy and returns the original registered deed.

Step 7: Receive Registration Certificate

Processing time: ~7 working days.

Some states may verify the registered office address before issuance.

Why Choose NYAY SARTHI INDIA FILINGS?

✔ End-to-End Legal Support – From name selection to final registration.

✔ Expert Drafting – Watertight trust deeds compliant with all laws.

✔ State-Specific Guidance – Stamp duty, trustee requirements, etc.

✔ Fast & Hassle-Free Processing – Minimal delays, maximum efficiency.

Start your trust registration today! Contact NYAY SARTHI INDIA FILINGS for seamless legal assistance. 📜✨

Documents needed for Trust Registration:

Request Letter for Society Registration – Required Documents Checklist

Prepared by NYAY SARTHI INDIA FILINGS

To ensure smooth processing of your society registration, please submit the following documents:

Enclosures Required:

Two Copies of Memorandum of Association (MOA)

Must include:

✔ List of founder members

✔ Proposed governing body details

✔ Original signatures of all members

Two Sets of Rules & Regulations

Clearly outline:

✔ Society’s operational framework

✔ Roles & responsibilities of office bearers

✔ Membership guidelines

Affidavits

On ₹10 stamp paper

Signed by either President or Secretary confirming:

✔ Society’s name/title

✔ Authenticity of submitted documents

Proof of Residence

Self-attested photocopies of address proof for all members (any one):

✔ Aadhaar Card

✔ Voter ID

✔ Utility Bill (not older than 3 months)

Registered Office Proof

Submit any one:

✔ Property ownership documents (if owned)

✔ Rent agreement + landlord’s No Objection Certificate (NOC) on ₹10 stamp paper

Identification Proof of Members

Self-attested photocopies of (any one per member):

✔ PAN Card

✔ Passport

✔ Driving License

Why Choose NYAY SARTHI INDIA FILINGS?

✔ Documentation Assistance – We help draft MOA & bylaws compliant with the Societies Registration Act, 1860.

✔ End-to-End Support – From affidavit preparation to submission.

✔ Error-Free Processing – Minimize rejections with expert verification.

Need Help? Contact us today for a seamless society registration experience!

Frequently Asked Questions

What is a trust, and why should I register it?

A trust is a legal entity established to manage assets or pursue charitable, religious, or social goals. Registering your trust grants it legal recognition, ensures operational efficiency, and enhances public trust. Let NYAY SARTHI INDIA FILINGS guide you through a seamless registration process for credibility and compliance.

What documents are required for trust registration?

Documents Required for Trust Registration:

Trust Deed (containing objectives and terms)

Address Proof (rental agreement or ownership documents)

Trustees’ ID & Address Proof (Aadhaar/PAN/Passport)

Passport Photos of all trustees

NYAY SARTHI INDIA FILINGS ensures smooth documentation for your trust registration.

How long does the trust registration process take?

Processing time varies by state and case complexity, typically completing within 7-20 working days. NYAY SARTHI INDIA FILINGS ensures efficient handling of your registration process.

Who can become a trustee of the trust?

Any legally competent adult (Indian citizens or eligible foreign nationals) can serve as trustee. NYAY SARTHI INDIA FILINGS guides you through trustee selection and documentation.